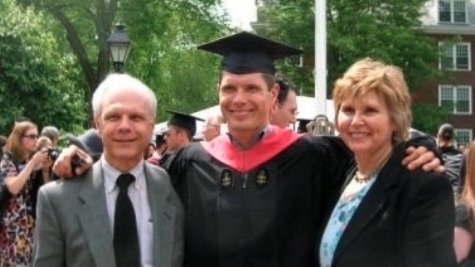

This guy who set out to crush his $90,000 in student debt in seven months has a lot of practical advice to save money; you know, the usual things: have roommates, get a second job, don’t eat out, get a flask … oh, and land yourself a six-figure job and that debt will be toast in no time! The Wall Street Journal posted this story last week with a tantalizing headline that you might have expected to be a tale of hope for the rest of us. But really it’s just about this guy, a 29-year-old graduate of Harvard Business School who now has a six-figure job at Dell, and before that worked for Mercedes Benz. And just like that, he payed off all of his $90k debt in seven months. Oh wait, he also stopped contributing to his 401k and liquidated his individual retirement account, which to me is the equivalent of saying he pawned his lightsaber and rented out his Batmobile, as I don’t know what to do with any of those things.

And he had to suffer the humiliation of using a flask. “The flask thing, it’s kind of demeaning,” he says. “The funny thing is that girls weren’t really sketched out by it … They did laugh, and I could still get their phone number. It taught me a lot — you don’t have to be this flashy dude, buying drinks.”

On his blog, he tries to respond to some of the criticism that not everyone can pull off this financial coup. In response to a message he got saying

I currently work full time and although I am blessed to have a job, it is relatively low paying.

I moved back home to try to save some money, but even then I am still struggling to make the minimum payments on my undergraduate student loans. What advise do you have?

Any ideas?

To which his response was:

To be honest, I’m afraid I don’t have any ideas. This person obviously took the right step to move back in with her parents rather than rent an apartment, and I have to assume she looked for a better job, but couldn’t find one. As far as next steps go, I really don’t have any ideas. I’m deeply sympathetic to her plight, and if I knew what to say I would say it, but I just don’t. I’m sorry.

Look, we’re not begrudging this guy for being successful and paying off his debt. Go forth and prosper! We do object to him being held up as a role model for the rest of us, who have all but given up hope of every paying down the debt. It’s just something you live with forever. Like the fact that I’ll never have a Batmobile.

6 Comments

Leave a Reply

don’t forget to mention getting rid of your 2nd car!

“The Murano just left my driveway. Good riddance. Washing two cars and a motorcycle was a serious pain in the tuches.”

is that a real thing he said? Oooof.

oh yeah, def! there are other gems on there I’m sure but I had to stop before I punched someone or thing in the face with frustration…

http://nomoreharvarddebt.com/2011/11/20/the-murano-is-gone-i-am-officially-on-track/

http://nomoreharvarddebt.com/2011/11/17/in-tears/

These articles are difficult for me to stomach. First they’re always super contrived. Secondly the first thing anyone ever mentions when trying to save money is to “move home with your parents”. As someone who doesn’t have a “home” per se to move back to this constant piece of advice really irks me. Lastly, of course this guy can pay off his loans to HARVARD within a year, its those of us that don’t go to top tier schools that have the real problem finding the money to pay back loans. Hey, NYT why don’t you write a piece about a 3rd tier business school grad who didn’t move back in with their parents and was able to pay off their loans in a year, that’s a story I would like to read.

“Only buy monocle polish twice a week and you’ll be out of debt in a matter of months!”

Oh and correction, I mean’t WSJ.