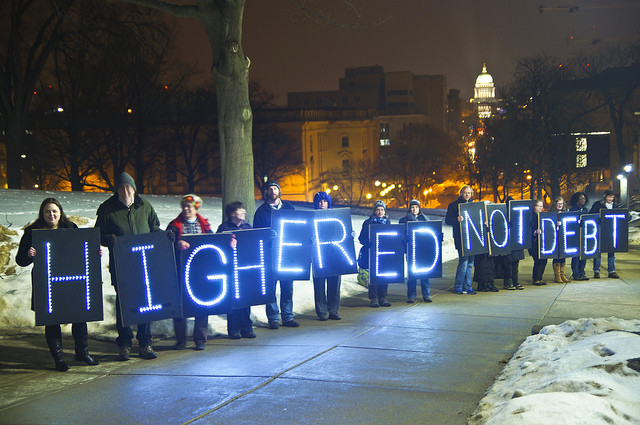

Student loans are like faces: if you don’t have one, I’m really not sure how to relate to you. I would say bitching about student loan debt has become a lingua franca of our generation, but that’s not really accurate, because no one really bitches about it so much as they accept it as part of their lives, like the fact you have to own a computer if you hope to be considered a real person in the world today. For most of us, student loans are an uncontrollable expense, the end of which exists somewhere far out beyond the horizon that our imaginations can’t picture. It’s a debt that has tripled to $1.2 trillion in the last decade, a stunning financial burden saddled on an entire generation that is often told it has no choice but to go to college, only to graduate and face low-paying jobs in cities with high rent — prospects that look even bleaker under the upcoming administration of President Rich Lives Matter. So what can we do? Here’s one option: make student loan repayment a job perk, like health care.

That’s what Penguin Random House, one of the world’s largest book publishers, has decided to do this week, joining dozens of other companies who have pledged to help employees pay off student debt. The publisher didn’t say the decision was a direct result of the election, but CEO Markus Dohle told employees it’s aligned with “doing our part to tackle broader societal challenges by starting within our own communities.”

It might be catching on: Making student loan repayment a job perk could become a big workplace trend next year.

Dohle said the decision grew out of conversations with staff that showed student loan debt burdens a lot of their staff, and could affect its future talent. The company will pay up to $1,200 of debt annually for an employee who’s been with the company for at least a year.

This is a good start. [I have no idea how I paid my rent & loans on my editorial assistant salary back in the day] https://t.co/LRhmdqVIZp

— jess (@Jess_Feld) November 15, 2016

Penguin Random House is not the first company to do this, but maybe the one that affects the greatest portion of our readers (yeah, we know a lot of you work in book publishing). PricewaterhouseCoopers and startup lender CommonBond have similar repayment programs; so does, apparently, the Moonlite Bunny Ranch, a legal brothel, in Nevada, according to Time Money.

This could become a trend: “Student loan repayment looks to be 2017’s hottest workplace benefit,” Kaitlin Mulhere wrote in Time Money yesterday. She cites a Fidelity survey that found 13 percent of the 129 companies surveyed offered student loan repayment assistance in 2016; 21 percent said they were considering it for 2017.

Whether this will spread to other companies, especially ones smaller than global publishers and finance firms, remains to be seen. We wouldn’t expect to see it filter down to smaller local companies, even the ones that offer health insurance (like, say, Beacon’s Closet). But for a large company, I think it actually makes more logical sense than offering health insurance coverage. We’re in a society where we’ve allowed our health care, the very basic ability to not bleed to death, fix a broken bone, get antibiotics or just breathe (s/o to my asthmatics out there) to be forever tied to our workplace and controlled by our bosses, fusing capitalism and human health in an unholy shotgun marriage (think of all the people you’ve known who have taken a crappy job just for the health insurance). We can’t fix that now, or maybe ever at this rate, but that doesn’t make it any less of a clashing outfit of modern life.

College education, however, and the student loans that are required to pay for it if you’re not a grandchild of Richard and Emily Gilmore, are tied to your workplace. We’ve been pushed to go to college since our first day we carried a Scooby Doo lunchbox into elementary school, and the path to adulthood is portrayed as one big running start to leap past the final hurdle of college. But college is expensive, and getting more so. Alleviating college costs had one brief blip of attention on the national stage when Bernie Sanders was in the running for president; after that it fell off the radar of the political discourse, replaced with the overarching discussion of “should we be racist or nah?”

Yes, not everyone goes to college, and there’s a whole shrinking world of hugely profitable skilled trade jobs that young people aren’t embracing, but that’s for a different discussion.

As someone who briefly attended a school (George Washington University) that was a real estate acquisition company masquerading as an actual college, it seems unlikely colleges would take an interest in lowering costs on their own (I soon transferred to the much cheaper — and much more pleasant — University of Maryland). Debt could actually get worse over the next four years.

An employer investing in their employees’ financial future means they recognize the actual financial burdens we face, and are helping tackle them, when the public sector is clearly not going to do anything about it. It means workplaces value people who went to good colleges, even if they’re not from backgrounds of means. It means that companies can recognize, yeah, this system is kinda fucked huh? and do something about it.

Leave a Reply