One day last year I came home from a grocery store run to a strong smell like a barbecue in my living room. It turns out my then-roommate lit incense in a flowerpot and then left for the night. The fragrant cone burnt down and ignited the soil. Yep, soil burns if it’s dry enough, and it burns slow and HOT. Had I come home a couple of hours later, my entire apartment would have been in flames and with it everything I own. After that close call I realized I needed two things: 1. to get rid of that roommate and 2. get renter’s insurance ASAP. And you should, too (except the roommate part, probably).

Thing is, insurance can be a nightmare, especially when making a claim. That’s because hundreds of years of tradition have left us with an insurance system designed to make it hard for everyone involved. Oh, well. That’s the price of protecting yourself and it will never change, right? Wrong. Lemonade is bringing insurance back to its roots, making claims easy and promoting the public welfare at the same time.

In the “normal” system, you pay your insurer a monthly fee to protect, say, your smart TV and bicycle. If someone climbs up your fire escape and cleans out your bedroom, you turn to your insurer for reimbursement. Except they don’t want to give you money. Settling your claim directly affects their bottom line. The more money they give you, the less they keep themselves. So you’ll spend weeks, months even, trying to get what’s yours.

“If you tried to create a system to bring out the worst in people, you would end up with one that looks like the current insurance industry,” Lemonade Chief Behavioral Officer Dan Ariely says.

During the Enlightenment, someone came up with the bright idea to insure things for profit, bucking a 5,000-year trend of indemnity for the common good. We went from communities sharing risk with each other to corporations distributing risk among their customers. That helped create the explosion in trading that has brought us modern capitalism and all the good and ills therewith. It also made protecting yourself and your stuff arduous and expensive.

Now that we’ve had 500 years of this fun social experiment, it’s time to try something new. Enter Lemonade with a revolutionary idea: Make it easy for people to complete their claims and give any leftover money to deserving causes. To do that, they’ve had to change the entire profit model.

Instead of throwing every monthly premium into a bucket to use as their piggy bank, Lemonade takes a flat fee and uses the rest to insure its customers. Here’s the crazy part: any money left over in the pool at the end of the year doesn’t go into their pockets; they give to a social cause or charity of your choosing.

While this whole new business structure is a Lemonade innovation, they’ve kept all the good parts of traditional insurance. They are fully licensed by state regulators, meaning they’re on the level. And they’re rated and backed by the biggest names in the industry, so you can trust they’ll be there when you need them.

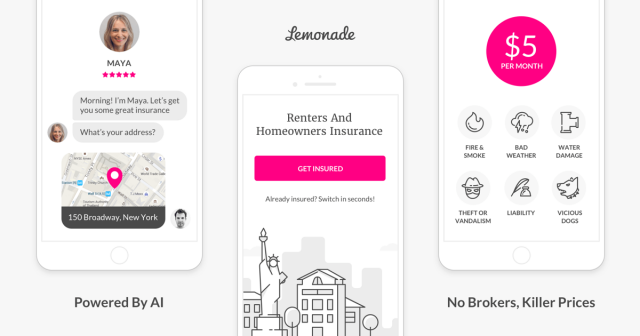

Lemonade has also changed the game by creating an app with custom, sophisticated AI to generate policies and process claims. Their system is so fast and easy to use, they recently set the world record for paying a claim: an unbelievable 3 seconds! And the app takes away middleman brokers with dollar signs in their eyes jacking up the price because they think you can afford it.

Since you’re reading Brokelyn, we figure you’re not into dropping tons of money on a monthly premium payment. We get that. But you can’t afford to do is forgo insurance, which is why we’re telling you about Lemonade. They cover everything, from your Macbook to your scrapbook. Fire, flood, theft — these things happen, especially in New York City! Just ask Brokelyn alum Rebecca, who lost all her stuff to an electrical fire.

Lemonade offers New York and California residents renter, condo and homeowner insurance and renter insurance in Illinois. They’re expanding nationwide and should cover most the US by year’s end.

Visit their page to learn more about how their new approach to insurance works. Download their app to start protecting your stuff now.

Leave a Reply